Are you ready to maximize the value of your business and navigate the complexities of selling with ease?

Don’t embark on this journey alone. Our team of experts can provide the strategic guidance, financial acumen, and negotiation skills needed to ensure a successful sale.

Selling a business is a complex process that requires strategic planning, timing, and tactics. It’s crucial to understand both external market conditions and internal factors like your company’s financial performance and personal readiness to sell. Preparing your business for sale involves accurate financial records, independent audits, and securing key employees. Determining the market value of your business involves reviewing tangible and intangible assets, future earnings, and industry trends.

Crafting a successful exit strategy involves defining personal goals, identifying the ideal buyer, and marketing your business successfully. Negotiating the sale requires understanding the buyer’s motivation, knowing your bottom line, and maintaining professionalism. Legal considerations include confidentiality agreements, letters of intent, purchase agreements, and possible regulatory approvals. Expert advice can help navigate this complex journey towards a successful sale and a new beginning.

Table of Contents

- Introduction: The Importance of Timing and Tactics in Selling Your Business

- Understanding the Right Time to Sell Your Business

- Evaluating Your Business: Key Factors to Consider Before Selling

- Tactics for Preparing Your Business for Sale

- How to Determine the True Market Value of Your Business

- Essential Steps in Crafting a Successful Exit Strategy

- Marketing your Business for Sale: Effective Strategies and Techniques

- Negotiating the Sale: Tips and Tricks for Maximizing Profit

- Legalities Involved in Selling a Business: What You Need to Know

- Final Thoughts

Introduction: The Importance of Timing and Tactics in Selling Your Business

Selling a business is not merely a financial transaction. It is an intricate process that requires strategic planning, meticulous evaluation, and savvy negotiation skills. One of the most crucial elements in this complex journey is the mastery of timing and tactics. Choosing the right time to sell your business can maximize its value, while employing effective tactics can ensure a smooth selling process with optimal results. Understanding when to sell your business involves analyzing market conditions, industry trends, and your company’s financial performance.

On the other hand, determining how to sell it encompasses several aspects, from preparing your company for sale to crafting an exit strategy that aligns with both your personal goals and the company’s needs. In this comprehensive guide, we will delve into each step of selling a business – from gauging the perfect timing to implementing clever tactics that will lead you towards a successful deal closure. This guide aims not only to equip you with valuable insights but also to inspire confidence as you navigate through this momentous phase in your entrepreneurial journey.

Understanding the Right Time to Sell Your Business

Knowing exactly when to put up a ‘for sale’ sign on your business isn’t always clear-cut; it’s often more art than science. However, some indicators suggest it may be an ideal time for owners contemplating selling their businesses. Firstly, consider external factors such as economic conditions. If businesses similar to yours are being bought frequently and at high prices, or if there is significant growth projected for industries like yours – these might be signs that now’s a great time for sale.

Next comes internal factors like consistent profitability over years showing an upward trend- indicating strong future cash flows which potential buyers would find attractive. Also, if you’ve recently achieved major milestones (like launching a new product successfully) or foresee major investments needed (like technology upgrades) which could drain resources- it might be time to consider an exit. Finally, personal reasons like retirement, health issues, or simply the desire to pursue other opportunities could also make it the right time for selling.

Here are the 10 Key Indicators to Determine the Right Time to Sell Your Business:

- Market Conditions: The current state of the market, including industry trends, consumer behavior, and economic indicators can all play a significant role in determining the right time to sell a business. If your industry is in an upward trend with high demand, it could be the perfect time to sell.

- Business Performance: A consistent record of strong financial performance and profitability is attractive to potential buyers. If your business has been showing strong growth and profitability for several years, it might be an ideal time to sell.

- Major Milestones: Achieving major milestones such as launching a successful new product or service, acquiring a significant number of new customers, or expanding into new markets can increase the value of your business and make it more attractive to potential buyers.

- Future Investments: If you foresee significant future investments that could strain your resources or change the business’s direction, it might be a good time to sell. This can include large-scale technology upgrades, expansion plans, or major changes in the business model.

- Personal Factors: Personal factors such as retirement, health issues, or a desire to pursue other opportunities can also influence the decision to sell the business. If you feel that you can no longer contribute to the business as you used to or if you want to shift your focus to other areas, it could be the right time to sell.

- Business Valuation: A high business valuation can be a strong indicator that it’s a good time to sell. If your business is valued highly due to its assets, customer base, or brand reputation, it could attract a higher selling price.

- Industry Consolidation: If there is a wave of mergers and acquisitions happening in your industry, it might be a good time to consider selling as larger companies could be interested in buying your business to expand their footprint.

- Succession Planning: If you don’t have a succession plan in place or if your potential successors are not ready or interested in taking over, selling could be a viable option.

- Regulatory Changes: Changes in regulations that could have a significant impact on your business’s operations or profitability might make it a good time to sell.

- Interest from Potential Buyers: If you’re receiving unsolicited offers from potential buyers, especially if those offers are attractive, it might be a good time to consider selling.

Evaluating Your Business: Key Factors to Consider Before Selling

Before you put your business up for sale, you need to evaluate its worth objectively. The first step is reviewing your financial performance which includes revenue trends, profitability, cash flow, and debt levels. Potential buyers will scrutinize these factors closely as they reflect the financial health of your business. The next factor is competitive positioning. A strong market position can increase the value of your business as it promises potential growth opportunities. Conversely, a weak positioning might necessitate investing in improvements before selling.

Other important considerations include assessing tangible assets (like property or equipment) and intangible ones (like brand reputation or customer loyalty). Also, evaluating operational efficiency and scalability potential can provide insights into how attractive your business might be to potential buyers. Finally, personal readiness should be assessed too, as selling a business isn’t just a transactional event, but also an emotional journey involving significant change which needs preparation both at a professional and personal level.

- Reviewing Financial Performance: Consider your company’s financial history, including revenue trends and profitability. Are you experiencing a growth in sales? Is profit consistent? This will be crucial information for potential buyers.

- Evaluating Cash Flow and Debt Levels: A healthy cash flow shows your business’s ability to cover its expenses and debts, which is crucial for buyers. The level of debt could affect the selling price and the buyer’s decision.

- Analyzing Competitive Positioning: Your business’s position in the marketplace can have a significant impact on its value. If you have a strong market position, it may boost the value of your business. If it’s weak, you may need to invest in improvements before selling.

- Assessing Assets: The tangible assets like property and equipment and intangible ones like brand reputation or customer loyalty, can increase the value of your business.

- Evaluating Operational Efficiency: How well does your business operate? A business with high operational efficiency is more attractive to buyers.

- Scalability Potential: Can your business easily scale up? Potential buyers will be interested in a business that has the potential for growth.

- Assessing Personal Readiness: Selling a business is an emotional journey. It’s important to assess whether you are emotionally ready to let go of your business.

- Legal and Regulatory Compliance: Buyers will want to ensure that the business is in compliance with all relevant laws and regulations. Any legal issues could lower the value of the business.

- Employee Relations: The morale and productivity of your employees could significantly impact the value of your business. Buyers will be interested in a business with a motivated and productive workforce.

- Customer Base: The loyalty and size of your customer base can increase the value of your business. Businesses with a large and loyal customer base are more attractive to buyers.

Tactics for Preparing Your Business for Sale

When preparing to sell your company, consider these tactics: Firstly, ensure all financial records are accurate and updated- prospective buyers would want a thorough understanding of the company’s financial history. Also, conduct an independent audit – a clean audit report can greatly enhance credibility amongst potential buyers thereby improving chances of a successful sale. Secondly, consider hiring experienced professionals like lawyers or brokers who not only bring expertise but also add credibility in the eyes of the buyer, making the process smoother.

Thirdly, increase focus on profitability – cutting unnecessary costs while boosting sales wherever possible, thus creating the impression that the company is a well-managed, profit-generating machine attractive to any buyer. Fourthly, secure key employees – their departure could raise red flags about future performance affecting sale price negatively while ensuring their stay sends positive signals regarding stability post-sale. Finally, prepare an appealing information memorandum providing a compelling narrative about why your company represents an excellent investment opportunity to potential buyers.

- Improve Business Processes: Streamline and document all business processes to show potential buyers that the company can run efficiently without you.

- Clear Any Debts: If feasible, try to clear any outstanding debts or other financial obligations that could devalue the business.

- Enhance Online Presence: Update your website, social media accounts, and any online listings to give potential buyers a positive impression of your business.

- Maintain Business Appearance: Keep your premises, equipment, and any vehicles in good condition to add value to the business.

- Build a Strong Management Team: A competent leadership team can provide assurance to potential buyers about the company’s future performance.

- Identify Potential Buyers: Establish a list of potential buyers who might be interested in your business, including competitors, suppliers, customers, or even employees.

- Secure Intellectual Property: Protect your intellectual property rights to enhance the value of your business.

- Plan for Transition: Develop a plan for how the business will run after the sale, which will give potential buyers confidence in a smooth transition.

- Mitigate Risks: Identify potential risks to your business and take steps to mitigate them. This could include anything from legal risks to market or operational risks.

- Market Your Business: Actively promote your business for sale through various channels to attract a broad range of potential buyers.

How to Determine the True Market Value of Your Business

Determining a business’s true market value is more complex than simply looking at its balance sheet. It involves assessing both tangible and intangible assets, future earning potential, industry trends, and marketplace comparisons. One commonly used method is the earnings multiplier approach which calculates business value based on its profit. Another method is discounted cash flow (DCF) analysis which estimates future cash flows and discounts them back to present value. Additionally, benchmarking against recent sales of similar businesses in your industry can provide insights into what buyers might be willing to pay. Consider consulting with a professional appraiser or broker who can provide an objective valuation based on their expertise and knowledge of current market conditions.

- Thorough Financial Analysis: This involves examining the financial statements of your business over several years to assess profitability, revenue growth, cash flow, and other key financial indicators.

- Asset Evaluation: Assess the value of both tangible (property, equipment, inventory) and intangible assets (trademarks, patents, goodwill) of your business.

- Earnings Multiplier Approach: Calculate the business value based on its net profit. This method is best suited for stable businesses with predictable earnings.

- Discounted Cash Flow Analysis: This approach estimates the present value of your business’s future cash flows, taking into account the time value of money.

- Industry Trends: Study current and future industry trends to understand how they might affect your business’s value.

- Market Comparisons: Compare your business to similar businesses that have recently been sold to get an idea of what buyers might be willing to pay.

- Future Earning Potential: Consider the future earning potential of your business, factoring in elements like growth, projected market share, and expansion plans.

- Customer Base and Relationships: A strong customer base and solid relationships can add significant value to your business.

- Professional Appraisal: Hire a professional appraiser or broker who can provide an objective valuation of your business based on their expertise and understanding of current market conditions.

- SWOT Analysis: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to identify factors that could affect your business’s value. For instance, a unique strength or opportunity could increase the value, while a significant weakness or threat could decrease it.

Essential Steps in Crafting a Successful Exit Strategy

Crafting a successful exit strategy begins with defining your personal goals – whether it’s retirement planning, starting another venture, or something else. The next step involves deciding on the ideal buyer profile – whether it’s a strategic buyer (interested in synergies with their existing business), financial buyer (focused purely on investment returns) or an internal transition where management or family members take over.

Then comes valuation followed by preparing a marketing plan for reaching out to potential buyers through various channels like online platforms, trade associations etc. Once interested parties are identified, the due diligence process ensues whereby potential buyers evaluate the business thoroughly before finalizing deal terms through negotiations. Finally, after the deal closure, there’s a transition phase where control gets transferred from the seller to the buyer while maintaining operational continuity.

- Define Your Personal Objectives: Understand your reasons for exiting the business, whether it’s for retirement, starting a new venture, or for other personal reasons. Your objectives will dictate the type of exit strategy you’ll pursue.

- Identify Potential Buyers: Based on your exit objectives, determine the ideal buyer profile. This could be a strategic buyer, a financial buyer, or an internal transfer to existing management or family members.

- Establish the Business Value: Engage a professional valuator to determine the value of your business. This will give you a realistic expectation of what your business is worth and help you negotiate the best deal.

- Create a Marketing Plan: Develop a comprehensive marketing plan to reach out to potential buyers. This could involve online platforms, industry events, and trade associations.

- Screening and Due Diligence: Once potential buyers express interest, screen them to ensure they have the financial capability and strategic fit. They will then conduct due diligence to assess the viability of your business.

- Negotiate Terms: Once due diligence is complete, negotiate the terms of the deal. This may involve aspects like price, payment terms, and transition period.

- Deal Closure: After all terms are agreed upon, finalize the deal through legal contracts and agreements.

- Transition Phase: After deal closure, there will be a transition period where operational control is transferred from you to the buyer. This phase ensures business continuity and minimal disruption.

- Post-exit Role: Depending on the agreement, you may have a role in the business post-exit. This could be as a consultant or advisor for a certain period.

- Monitor Progress: Even after the exit, keep an eye on the business’s progress. This will help you ensure that your legacy is preserved and that the business continues to thrive under new ownership.

Marketing your Business for Sale: Effective Strategies and Techniques

When it comes time to sell your business, effective marketing strategies can play an instrumental role in attracting qualified buyers. A well-crafted information memorandum that highlights the key selling points of your company – be it a strong customer base, proprietary technology, experienced team, or high growth prospects – can pique interest among prospective buyers. Online listing services offer wide exposure while industry-specific publications or trade associations can help reach targeted buyer groups. Engaging a business broker can also be advantageous as they have access to a network of potential buyers and expertise in marketing businesses for sale.

- Leverage Social Media: Create a solid presence on social media platforms like LinkedIn, Facebook, and Twitter. These platforms provide a wide audience and can help generate interest.

- Use Video Marketing: Create a professional video that showcases the strengths of your business. This can be used on your website, social media, and online listings.

- Optimize SEO: Make sure your website and online listings are optimized for search engines. This will increase visibility and attract more potential buyers.

- Host Networking Events: Hosting industry-specific events can be an effective way to meet potential buyers and create a buzz around your business.

- Create A Strong Brand Story: A compelling brand story can attract buyers who are looking for more than just a profitable business. They want to invest in a vision and a mission.

- Utilize Email Marketing: Send an email to your existing customers and contacts announcing the sale of your business. This can generate word-of-mouth advertising and potential leads.

- Leverage Customer Testimonials: Showcase testimonials from satisfied customers to build credibility and attract potential buyers.

- Offer Free Trials or Demos: If applicable, offering free trials or demos of your product or service can attract potential buyers.

- Use Content Marketing: Publish informative and engaging content related to your business and industry on your website and social media platforms. This can establish you as an industry leader and attract potential buyers.

- Hire a Public Relations Agency: A professional PR agency can create a strategic communication plan to effectively market your business for sale, including press releases, media outreach, and crisis management.

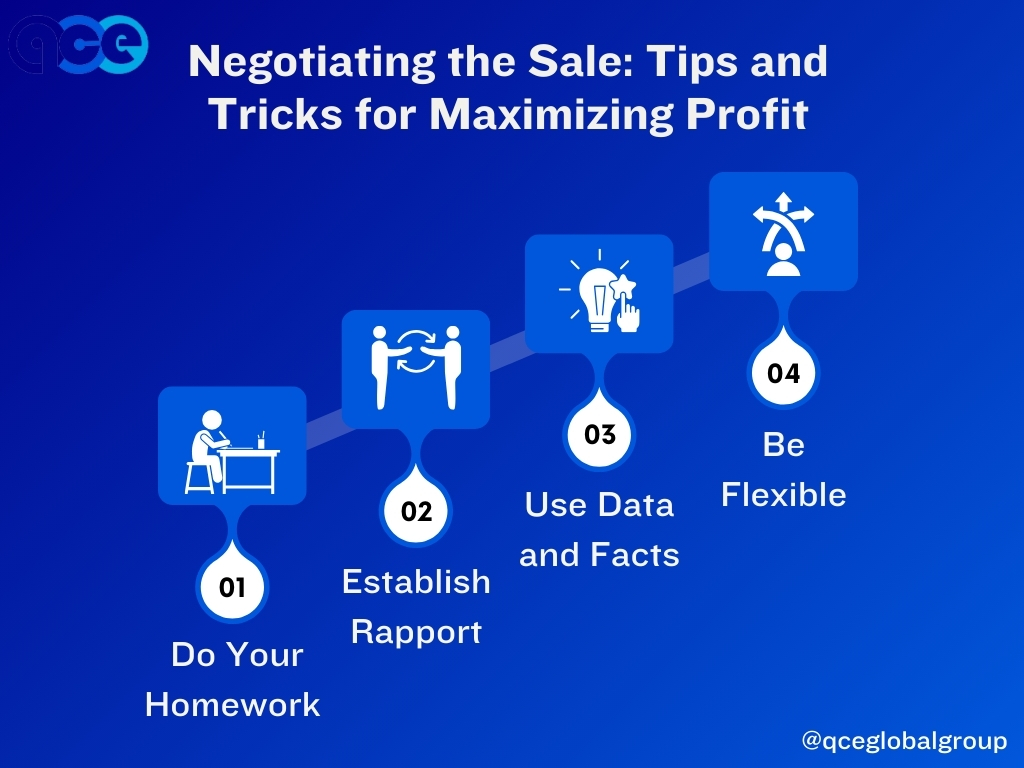

Negotiating the Sale: Tips and Tricks for Maximizing Profit

Negotiation is both an art and a science, requiring skills in communication, strategic thinking, and emotional intelligence. Here are a few tips: Firstly, know your bottom line – the lowest price you are willing to accept – but aim higher initially, leaving room for negotiation. Secondly, understand the buyer’s motivation – whether they see a strategic fit with their existing business or purely a financial investment opportunity- tailoring your pitch accordingly. Thirdly, don’t appear too eager to sell, which might lead buyers to suspect desperation thereby weakening your negotiating position. Finally, always maintain a professional attitude even when negotiations get tough – remember, it’s just business, not personal!

- Do Your Homework: Research about the buyer’s company, their financial capabilities, and their business needs. This will give you an edge in the negotiation process.

- Establish Rapport: Building a good relationship with the buyer can help smooth the negotiation process. A positive rapport can lead to better understanding and mutual respect.

- Be Patient: Negotiations can be lengthy and complicated. Stay patient and don’t rush the process. Hasty decisions can often lead to poor outcomes.

- Use Silence Strategically: Silence can be a powerful tool in negotiation. It can make the other party reveal more information or reconsider their stance.

- Practice Active Listening: Show genuine interest in what the buyer is saying. This not only builds trust, but also helps you gather valuable information for your negotiation.

- Be Flexible: Be prepared to adjust your terms and conditions if necessary. This shows your willingness to compromise and can help move the negotiation forward.

- Use Data and Facts: Back up your claims with solid data and facts. This will make your proposal more convincing and credible.

- Understand the Power of Timing: Knowing when to make your offer or when to walk away can greatly influence the outcome. Timing is critical in negotiation.

- Leverage Your Strengths: Highlight the unique value your business brings to the table. This can make your offer more attractive and give you a stronger bargaining position.

- Seek Professional Help: If you’re finding the negotiation process challenging, consider hiring a professional negotiator or business broker. They can provide expert advice and help you get the best possible deal.

Legalities Involved in Selling a Business: What You Need to Know

There are several legal considerations involved when selling a business. Confidentiality agreements protect sensitive information from being misused if the deal falls through, while a letter of intent outlines a preliminary agreement between the seller and buyer before detailed due diligence commences. Once due diligence is completed, a purchase agreement gets drafted outlining final terms including price, payment structure, liabilities assumed by the buyer, etc. Also, there may be regulatory approvals required depending on the nature of the business or size of the transaction, hence getting legal advice is crucial to ensuring a smooth process and avoiding potential costly mistakes.

- Understanding Legal Responsibilities: It’s important to understand the legal obligations when selling a business, such as disclosing accurate financial information to potential buyers. Providing misleading information can lead to legal repercussions.

- Intellectual Property Transfer: The sale of a business often includes the transfer of intellectual property. This must be carefully managed to ensure all patents, trademarks, or copyrights are legally transferred.

- Employee Rights: The sale of a business has implications for employees. Legal advice is necessary to ensure compliance with labor laws and to understand the obligations towards employees during and after the sale.

- Tax Considerations: The sale of a business can have significant tax implications. Therefore, it’s important to seek expert advice to understand and plan for these potential liabilities.

- Real Estate and Lease Agreements: If your business has physical locations, the transfer of property and lease agreements is a critical legal consideration.

- Handling Existing Debts and Liabilities: Legal advice is needed to manage how existing debts and liabilities of the business are handled in the sale.

- Non-Compete Agreements: Sellers may be required to sign a non-compete agreement, preventing them from starting a similar business within a certain timeframe and geographic area.

- Confidentiality Agreements: Legal expertise is required to draft and enforce confidentiality agreements to protect sensitive information during the sale process.

- Regulatory Approvals: Depending on the industry and size of the business, various regulatory approvals may be required for the sale. Expert legal advice can help navigate this complex process.

- Drafting Purchase Agreement: A legal expert is needed to draft the final purchase agreement, ensuring all aspects of the sale are covered and legally binding. This includes price, payment structure, liabilities assumed by the buyer, and more.

Final Thoughts

Selling a business involves a myriad of decisions, each having a significant impact on the final outcome. However, mastering the art of timing – understanding when external market conditions are favorable combined with internal readiness – along with implementing effective tactics throughout the process from preparation to closure can ensure a successful sale yielding maximum returns, rewarding all those years spent building up the venture. Remember, this journey, while complex, need not be navigated alone – seek expert advice wherever needed, making informed choices leading towards a fruitful conclusion. After all, selling your business is not the end, rather a new beginning opening up myriad possibilities for the future.

Whether you’re just beginning to contemplate a sale or are ready to craft your exit strategy, we’re here to support you every step of the way. Contact us now for a consultation and let us help you turn your hard work into a rewarding payoff.

Your successful business journey deserves a successful sale. Let’s make it happen together!